Week in Washington is brought to you by Michael Cohen, PhD. Tune in each week to read the latest on healthcare policy and get a glimpse of what’s on the horizon.

Week in Washington

7/30/20

Economic News

The big headline news this week was the drop in second-quarter GDP—a few thoughts on that.

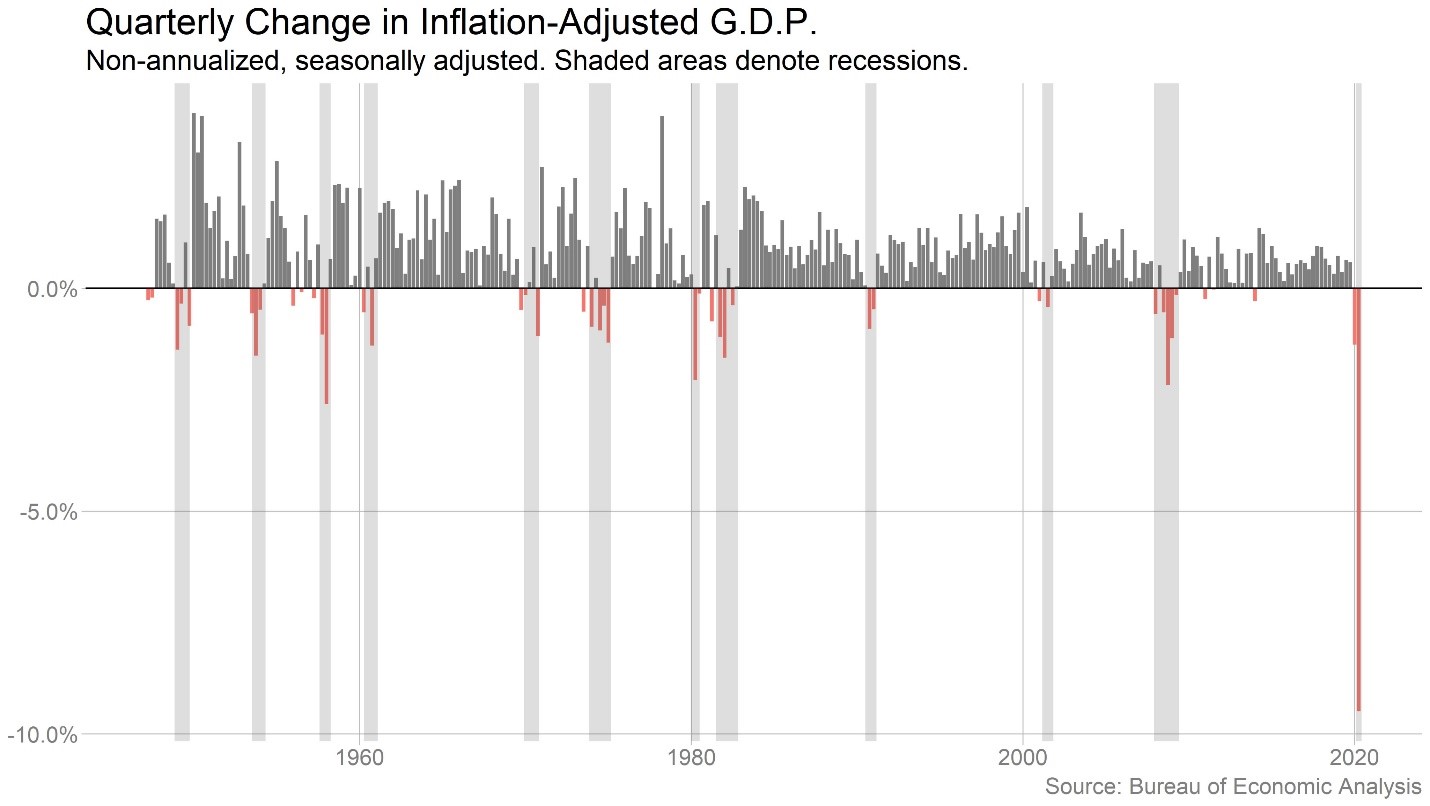

- While the headlines may read a GDP drop of 32.9% annualized, given the uniqueness of the pandemic, a more accurate figure is the approximately 10% quarter over quarter decline in GDP as can be seen in the above picture by Ben Casselman

- The 10% decline is the worst GDP quarterly decline since 1946 (i.e., the aftermath of WW2) and, in essence, wiped out five years of economic growth. Nearly 40% of those whose income was less than $40,000 lost their jobs during this time frame.

- About a third of the decline in GDP is directly attributable to the decrease in spending on health care. Overall, healthcare spending dropped 9.5% in 2Q at a seasonally adjusted annual rate.

- The major caveat is that personal income actually rose 7.3% because of government spending (PPP, unemployment assistance, economic assistance).

How has the economic upheaval affected enrollment for health insurers?

The Marketplace

- SEP enrollment has generally been higher in the Marketplaces relative to previous years. For the states that are reporting data, SEP enrollment is up about 28%. Healthcare.gov, which did not have a special COVID SEP enrollment, still saw a 27% increase in its SEP enrollment. State-based Marketplaces saw a wide-variation in SEP take-up, ranging from 97% in Connecticut to -18% in New York. CBPP has a good summary of SEP enrollment trends here. Unfortunately, there is not sufficient data to determine how overall Marketplace enrollment has changed as a result of the economic downturn (i.e., has the increase in SEP enrollment been offset by greater enrollment attrition by those already in the Marketplace).

Medicaid MCOs

- KFF has a great tracker of Medicaid MCO enrollment. KFF found that while MCO enrollment was negative between March 2019 and March 2020, enrollment increased 3.6% (median increase of 4.7%) between March 2020 and May 2020. In fact, enrollment increases have started to accelerate and could spike even more in the coming months.

Implications for Medicare Advantage

- While data is still being compiled, analysis by Avalere of Medicare Advantage growth rates in recent earning calls showed a significant spike in MA enrollment. Avalere’s MA growth projections estimate that MA could represent over 50% of Medicare enrollment by 2025 as a result of the economic downturn. They believe an increase in early retirement is likely the primary reason for the increases

Congress

One of the big influencers on enrollment patterns is likely future Congressional policies (e.g., PPP, unemployment insurance amounts, etc.) Currently, there is stalemate in Congress on future policies. Policy disagreements between and within parties have resulted in considerable uncertainty as to when/if Congress will pass another round of stimulus. Congress is expected to leave for recess in mid-August, so there is significant pressure for a deal to be struck in the coming weeks.

Happy 55th Birthday Medicare and Medicaid!

Previous editions:

07/23/2020: Week in Washington

07/16/2020: Week in Washington

07/9/2020: Week in Washington

6/25/2020: Week in Washington

6/18/2020: Week in Washington

6/11/2020: Week in Washington

6/4/2020: Week in Washington

5/28/2020: Grim Milestone